Understanding title loan interest rates is crucial for making informed financial decisions, as they are influenced by lenders' risk assessment, loan types (secured vs unsecured), and market conditions. To find the best deal, borrowers should compare lenders' terms and conditions, including requirements, fees, and collateral policies, such as those for motorcycle or semi truck loans. Shopping around from multiple lenders can secure competitive interest rates and favorable overall loan conditions.

Title loans, a quick source of cash secured against your vehicle’s title, come with varying interest rates across lenders. Understanding these rates is crucial for borrowers looking to make informed decisions. This article delves into the factors influencing title loan interest rate variations and offers strategies to compare rates effectively. By understanding how lenders set their terms, you can secure the best deal, ensuring a smooth borrowing experience without hidden costs or unfair practices.

- Understanding Title Loan Interest Rates: What You Need to Know

- Factors Influencing Title Loan Interest Rate Variations Across Lenders

- Strategies for Comparing and Securing the Best Title Loan Deal

Understanding Title Loan Interest Rates: What You Need to Know

When considering a title loan interest rate, it’s crucial to understand how it works and what factors influence it. These short-term loans, often secured by your vehicle’s title, come with a set of conditions that directly impact the cost you’ll incur. The primary determinant is the lender – rates can vary significantly between institutions. It’s not just about the number, but also the terms: loan duration, repayment methods, and any additional fees or penalties.

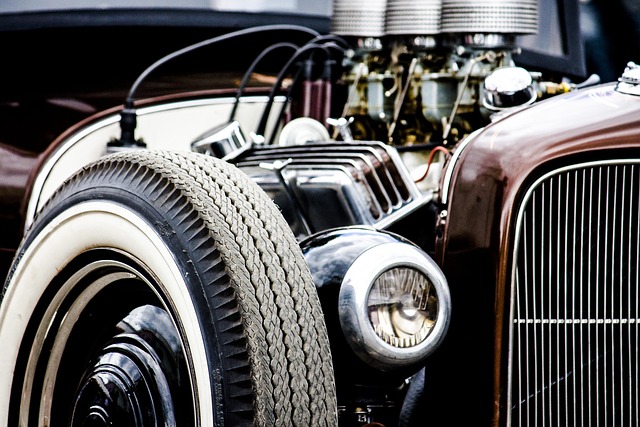

Understanding these variables empowers borrowers to compare title loan interest rates effectively. For instance, opting for a longer loan term might lower your monthly payment but could result in paying more in interest over time. Keep your vehicle and maintain flexibility with motorcycle title loans, as some lenders allow for this while still offering competitive rates. Accessing financial assistance through these loans can be beneficial, provided you’re mindful of the associated costs and commit to timely repayments.

Factors Influencing Title Loan Interest Rate Variations Across Lenders

Several factors play a significant role in the variations of title loan interest rates offered by different lenders. One key factor is the risk assessment each lender conducts based on an applicant’s creditworthiness, income stability, and Vehicle Ownership. Lenders weigh these aspects to determine the level of risk associated with extending a loan, which directly influences the interest rate charged. For instance, applicants with lower credit scores or unstable incomes may face higher rates compared to those with excellent credit history and steady employment.

Another crucial element is the type of loan offered—secured or unsecured. Secured loans, backed by Vehicle Ownership, often come with lower interest rates since lenders have collateral to mitigate potential losses. In contrast, cash advance loans without collateral typically carry higher rates due to their short-term nature and perceived higher risk. Market conditions, including economic trends and industry competition, also impact rates, pushing them up or down across different lenders.

Strategies for Comparing and Securing the Best Title Loan Deal

When comparing title loan interest rates across lenders, it’s crucial to assess each lender’s terms and conditions thoroughly. Start by gathering detailed information about their loan requirements, including minimum credit scores, income thresholds, and vehicle appraisal standards. This step is essential as these factors can significantly influence the final interest rate offered. Pay close attention to any hidden fees or additional charges that may be attached to the loan.

Next, consider how keeping your vehicle can impact your interest rates. Many title lenders offer better terms for borrowers who need to keep their vehicles as collateral. This is especially relevant when considering loans for assets like semi truck loans. Compare these options with those that require you to hand over your vehicle during the loan period. Finally, don’t forget to shop around; multiple quotes from different lenders will empower you to secure the best deal in terms of both interest rates and overall loan conditions.

When comparing title loan interest rates, it’s essential to consider various factors that can impact your final cost. By understanding what influences these rates and employing strategic comparison methods, you can make an informed decision and secure the best title loan deal. Keep in mind that shop around, evaluate multiple lenders, and consider not just rates but also terms and conditions to ensure a favorable borrowing experience.