Understanding title loan interest rate calculation (based on loan amount, collateral value, repayment period) and improving loan eligibility through strong credit scores can significantly reduce borrowing costs. Shopping around lenders, maintaining vehicle condition, timely repayments, and flexible plans optimize strategies to manage and minimize interest charges, ensuring affordable title loans.

Title loans offer quick cash, but understanding and managing interest rates is crucial. This guide provides smart tips to navigate title loan interest rate calculations, helping you make informed decisions. Learn effective strategies to lower your interest expenses and optimize repayment terms for better rates. By following these steps, you can ensure a more manageable financial experience with a title loan, making it a practical choice for short-term funding needs.

- Understanding Title Loan Interest Rate Calculations

- Strategies to Lower Your Interest Expenses

- Optimizing Repayment for Better Rates

Understanding Title Loan Interest Rate Calculations

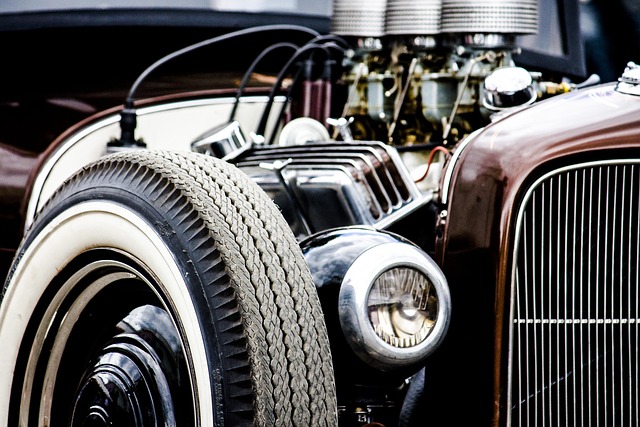

When it comes to Title Loan interest rates, understanding how they’re calculated is crucial for borrowers. These rates are typically based on a complex formula that considers several factors, including the loan amount, the value of the collateral (in this case, the vehicle’s title), and the agreed-upon repayment period. Lenders assess these elements to determine a daily interest rate, which is then multiplied by the number of days in the loan term to arrive at the total cost of borrowing.

Knowing your Loan Eligibility is key to managing interest rates effectively. Borrowers with strong credit scores and a clear vehicle title often secure more favorable terms, including lower interest rates and same-day funding. Additionally, being aware of your financial situation allows you to make informed decisions about repaying the loan on time, avoiding penalties, or exploring options for a Loan Extension if needed, thus keeping interest expenses in check.

Strategies to Lower Your Interest Expenses

When considering a title loan, one of the primary concerns is managing interest rates to minimize financial burden. There are several strategies to lower your interest expenses. Firstly, compare different lenders and their interest rate structures. Different institutions may offer varying terms, so shopping around can help you find the most favorable rates. Secondly, focus on maintaining a good credit score as it can significantly impact your interest rates. A strong credit history typically translates to better borrowing conditions.

Additionally, understanding how your title loan’s interest is calculated is crucial. Lenders often base interest on factors like vehicle valuation and loan duration. Keeping your vehicle in good condition and ensuring its market value remains high can positively affect your interest rate. Prompt repayment of the loan can also reduce overall interest charges. By adhering to these strategies, you can effectively manage your title loan interest rates and ensure a more affordable borrowing experience.

Optimizing Repayment for Better Rates

One effective strategy to manage and potentially lower your title loan interest rates is through optimized repayment. Repaying your loan on time and in full can significantly impact your interest charges. Many lenders offer flexible repayment plans, allowing you to choose a schedule that suits your budget. Opting for automatic payments or setting up direct debits from your bank account ensures timely repayments, which can lead to better rate offerings from the lender.

Additionally, maintaining a good credit history is beneficial. While some title loan services may not conduct extensive credit checks, having a strong credit profile can still make a difference. Demonstrating responsible borrowing and repayment behavior through other financial commitments might encourage lenders to offer more competitive rates on your title loan, especially when paired with timely and consistent repayments.

Managing title loan interest rates effectively involves understanding how they’re calculated, employing strategies to lower expenses, and optimizing repayment terms. By staying informed and proactive, you can navigate these loans responsibly and make informed decisions regarding your financial needs, ensuring the best possible rate for your title loan.