Understanding and managing title loan interest rates is vital before securing a San Antonio Loan. Rates vary based on vehicle details, credit history, and loan amount. Maintaining good vehicle condition and meeting eligibility criteria can lower rates. Comparing lenders, negotiating, and improving credit scores help secure favorable terms. Strategic repayment plans and extra payments reduce overall costs, maximizing savings on title loans.

Managing title loan interest rates effectively is a key aspect of borrowing smartly. This article offers valuable insights into understanding and navigating these rates, with a focus on empowering borrowers. We delve into the intricacies of interest calculations, revealing how they impact your loan. Additionally, we explore practical strategies to lower expenses, emphasizing timely repayment techniques for better rate outcomes. By mastering these tips, you can confidently navigate title loan interest rates, ensuring a more favorable borrowing experience.

- Understanding Title Loan Interest Rate Calculations

- Strategies to Lower Your Interest Expense

- Maximizing Repayment for Better Rates

Understanding Title Loan Interest Rate Calculations

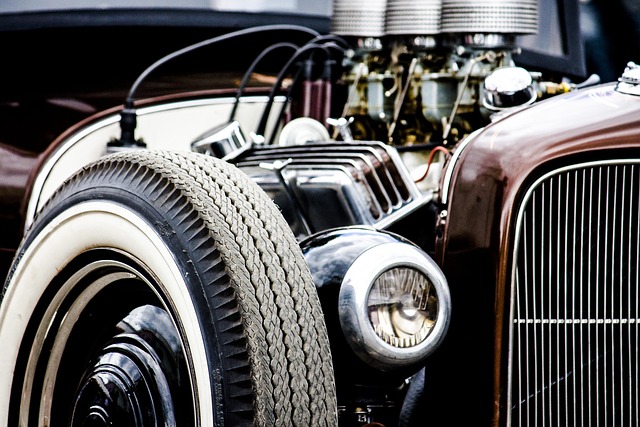

When considering a title loan, understanding how your interest rates are calculated is paramount. Unlike traditional loans where annual percentage rates (APRs) provide a comprehensive view, title loan interest rates are often expressed as a single percentage or fee. This rate reflects the cost of borrowing for a specific period, typically based on the loan amount and the agreed-upon terms. Lenders assess your vehicle’s value, its condition through a meticulous vehicle inspection, and your ability to repay to determine these figures.

Key factors influencing your interest rate include the type of vehicle you own (its make, model, age, and overall condition), your credit history, and the loan amount requested. Keeping your vehicle in good condition can positively impact the inspection outcome, potentially securing a lower interest rate. Additionally, meeting the lender’s minimum requirements for loan eligibility can enhance your chances of getting a more favorable rate.

Strategies to Lower Your Interest Expense

Managing title loan interest rates is a strategic process that can save you significant money over time. One effective strategy to lower your interest expense is to compare multiple lenders before making a decision. In San Antonio, there are numerous options available, each with varying interest rate structures. Thoroughly researching and understanding these rates will empower you to choose the most favorable terms for your San Antonio Loans. This might involve shopping around, asking about fixed versus variable rates, and negotiating with lenders to secure better conditions.

Another crucial step is to ensure that you meet the eligibility criteria without compromising your creditworthiness. While a credit check is inevitable in the loan process, maintaining or improving your credit score can lead to lower interest rates. Consider paying off existing debts promptly and avoiding new ones until necessary. This demonstrates financial responsibility to lenders, which can result in better terms for your cash advance. Additionally, understanding the lending market and staying informed about recent trends will enable you to make informed decisions regarding interest rates and overall loan terms.

Maximizing Repayment for Better Rates

Maximizing repayment is a strategic approach to managing your title loan interest rates. By paying off your loan faster, you can significantly reduce the overall cost, including the interest charges. This is because interest is often calculated on the outstanding balance, and the longer it takes to repay, the more interest you’ll accumulate. Therefore, creating a detailed repayment plan and adhering to it is essential.

One effective strategy is to make extra payments beyond the minimum required each month. Even small additional amounts can make a substantial difference over time. Additionally, consider the benefits of an online application process for title loans, which often provides faster approval times. This speed allows you to access your funds quicker and potentially start repaying earlier, further optimizing interest savings. Remember, effective financial management includes being proactive about loan repayment to minimize the impact of interest rates.

Managing title loan interest rates effectively is key to ensuring you get the best deal. By understanding how these rates are calculated, employing strategies to lower your expense, and maximizing repayment terms, you can navigate the process with confidence. Remember, proactive management of your title loan interest rates can save you significant money in the long run.