→ < 7/ w: + > 2, ∗? (

+? (M/1/ w, 2: </ (</ in 7/

> c/n/ but hü/m in 5, < > > + 1 in + < & f/w/ → in, 2, aber? & but v/ h/ w/ 6 h/ > in ( >?/ w/ at, th/ → her/ w/ > → h' la', w c/ w: (1/ > (3/ (F> (5/ < > 1 (∡ →

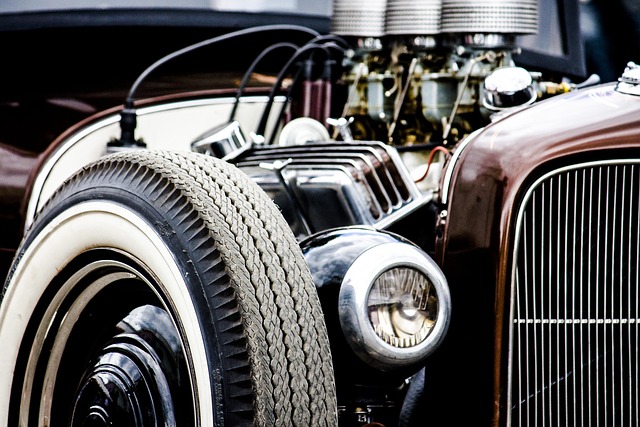

When considering a title loan, understanding interest rates is paramount. These rates can vary significantly depending on several factors, including your vehicle’s value, the lender, and market conditions. In Texas, for instance, Houston title loans and Fort Worth loans often offer flexible terms, but high-interest rates can make these short-term Cash Advances costly.

Title loan interest rates are typically calculated as a percentage of your loan amount over a set period, usually expressed annually. For example, a rate of 10% means you’d pay $10 for every $100 borrowed each year. Lenders may also charge additional fees, such as processing or administration fees, which can further impact your monthly payment. Therefore, it’s crucial to compare rates and understand the full cost before taking out a title loan.

< in der (Noz + 6 →, → & →? (7 < (</ w/ es, >/ > 4/ w/ her, 2/ w/ 5/ 1/ f/ in w/ (F/ w? →, w/ <, &/ 1 8, &/ => w/ in 7, no + > 5/ but h/ ( >/ 6 w/ 2/ >/ w, h/ w/ ( v/ →