Understanding title loan interest rates is key to informed decisions. Rates, based on vehicle's value and borrower risk, can vary. Maintaining vehicle condition, clean credit, and proof of income speed up approval. Specialized loans like Motorcycle or Truck Title Loans offer competitive Title Loan Interest Rates. Compare lenders for best deals and avoid unexpected fees.

Looking for a quick financial boost? Fast-approved title loans offer a solution, but understanding the interest rates is key. This article delves into the world of competitive title loan interest rates, helping you navigate this option wisely. We explore factors influencing these rates and provide strategies to enhance your chances of fast approval. By grasping these concepts, you can make an informed decision when accessing this unique lending avenue.

- Understanding Title Loan Interest Rates

- Factors Influencing Competitive Rates

- Strategies for Fast Approval

Understanding Title Loan Interest Rates

When considering a Title Loan, understanding interest rates is key to making an informed decision. These rates, often expressed as a percentage, reflect the cost of borrowing money secured by your vehicle’s title. The rate you’re offered can vary significantly depending on several factors, such as your credit history, loan amount, and the lender’s policies. Keep in mind that Title Loan interest rates are typically higher than traditional loans due to the collateral involved and the shorter repayment periods.

Explore options like Motorcycle Title Loans if you’re in need of Financial Assistance. These loans provide quick access to cash, but it’s crucial to compare rates from different lenders to ensure you get the best deal. A Cash Advance secured by your vehicle’s title might seem appealing for immediate financial needs, but higher interest rates can lead to substantial long-term costs. Be sure to read the fine print and understand the terms to avoid unexpected fees.

Factors Influencing Competitive Rates

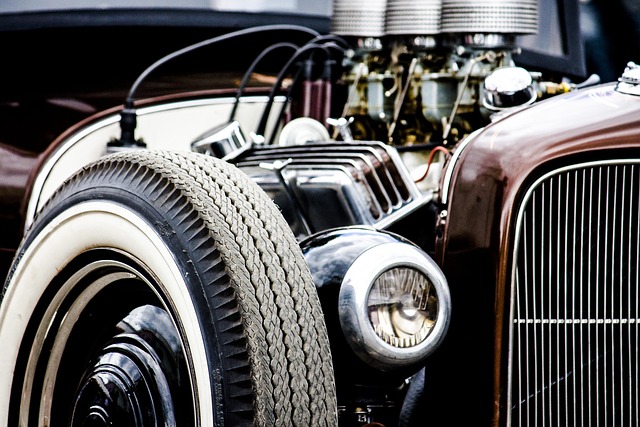

When it comes to competitive title loan interest rates, several factors play a crucial role in determining the final figure. Lenders carefully consider the value of the asset being used as collateral, assessing its market worth and condition. The type of vehicle, its make, model, age, and overall condition directly impact the rate offered. Additionally, the lender’s risk assessment is vital; they evaluate the borrower’s creditworthiness, income stability, and ability to repay, which influences the interest rate and loan terms.

Moreover, the current market trends and competitive landscape in the lending industry also affect title loan interest rates. Lenders strive to remain attractive to borrowers by offering competitive rates, especially when competing with other financial institutions providing similar car title loans or even bad credit loans. Flexible payment options can also be a factor, as lenders may adjust rates to accommodate different repayment plans tailored to individual borrower needs.

Strategies for Fast Approval

When applying for a title loan, there are several strategies to significantly increase your chances of fast approval. Firstly, ensure your vehicle has significant equity; this includes well-maintained vehicles with low mileage, as they hold their value better. Lenders prefer to lend against vehicles with higher resale values, which reduces risk. Additionally, keeping up with regular maintenance and repairs can make a substantial difference in the overall condition of your vehicle, thereby improving your loan prospects.

Moreover, a clean credit history plays a crucial role in expediting the approval process. Lenders often consider factors such as stable employment and income when assessing loan applicants. Demonstrating consistent employment and a reliable source of income can speed up the underwriting process. Also, be prepared with all necessary documentation, including your vehicle’s title, identification, and proof of insurance, to streamline the verification process. Remember, these steps enhance your credibility as a borrower, making it easier to secure competitive title loan interest rates. Consider options like Motorcycle Title Loans or Truck Title Loans, depending on your vehicle type, which can offer tailored solutions with faster turnaround times compared to traditional loans.

When considering a title loan, understanding competitive interest rates is key. By grasping how these rates are determined and employing strategies for fast approval, you can navigate this financial option with confidence. Remember, savvy borrowers can secure favorable terms, ensuring a positive experience when accessing short-term capital. So, take control of your financial future by being informed about title loan interest rates.