Title loan interest rates vary widely based on lenders' risk assessments, market conditions, and state regulations. While these loans offer fast access to cash and flexible payment plans, high rates can trap borrowers in a cycle of debt due to exponential fees and inflexible terms, limiting consolidation options. Prudent comparison is crucial to avoid substantial long-term costs.

High title loan interest rates can be a double-edged sword. While they offer lenders attractive returns, they also burden borrowers with significant financial strain. This article delves into the intricacies of these rates, providing a clear understanding of their pros and cons. We explore how high title loan interest rates affect borrowers and why they should carefully consider their options before taking out such loans. By the end, you’ll grasp the key factors influencing these rates and be better equipped to make informed decisions.

- Understanding Title Loan Interest Rates

- Pros of High Title Loan Rates

- Cons of High Title Loan Charges

Understanding Title Loan Interest Rates

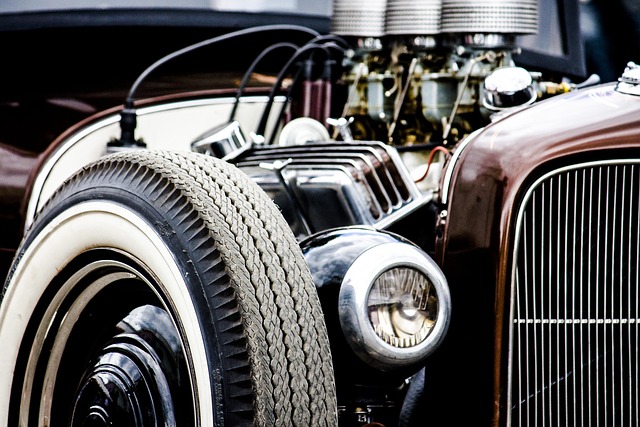

Title loan interest rates are a key factor to consider when looking into obtaining fast cash through options like truck title loans or title pawn. Understanding these rates is essential as they significantly impact the overall cost of borrowing. Interest rates on title loans are typically calculated as a percentage of the loaned amount and can vary widely between lenders. This variability is influenced by several factors, including the lender’s risk assessment, market conditions, and state regulations.

When considering a title loan, it’s important to compare interest rates from different lenders. Fast cash needs can be urgent, but taking time to research rates could save you substantial amounts in the long run. Rates for truck title loans or title pawn may seem appealing due to their fast access to funds, but high-interest rates can lead to a cycle of debt if not managed carefully.

Pros of High Title Loan Rates

High Title loan interest rates can offer several advantages for borrowers who understand their implications. One significant pro is the potential for faster access to cash. With higher rates, lenders are often more willing to provide loans, especially for individuals with less-than-perfect credit or limited financial history. This speed can be a lifeline in emergency situations or when quick funding is required.

Additionally, these rates can simplify the borrowing process. Many title loan services offer flexible payment plans tailored to individual needs, allowing borrowers to spread out repayments over time. This flexibility, coupled with a focus on vehicle valuation rather than extensive credit checks, makes high-rate title loans an attractive option for those seeking a straightforward and fast financial solution without the stringent requirements of traditional loans.

Cons of High Title Loan Charges

High title loan interest rates come with several drawbacks that borrowers should be aware of before taking out such a loan. One significant con is the potential for exponential debt growth. Since these loans are secured against an asset, like a boat title, high-interest rates can lead to substantial fees and charges if the borrower cannot repay on time. This can quickly turn into a cycle of debt, making it increasingly difficult to pay off the loan and its associated costs.

Another concern is the limited flexibility in repayment plans. Lenders offering boat title loans often have strict payment terms, leaving little room for negotiation or adjustments based on individual financial situations. Moreover, borrowers may face challenges in accessing traditional debt consolidation options due to the unique nature of these secured loans. This restricts opportunities to streamline payments and potentially reduce overall interest paid over time.

When considering a title loan, understanding the intricate dynamics of interest rates is paramount. While high title loan interest rates may seem daunting, they offer benefits like rapid funding and potentially lower overall costs compared to traditional loans. However, these rates also come with drawbacks, such as increased borrowing expenses and the risk of default escalating quickly. By weighing both pros and cons, borrowers can make informed decisions, ensuring they access funds responsibly and maintain financial stability.